In my prior life as Head of U.S. Portfolio Management at Sun Life Financial in Wellesley, MA, I helped manage $37 billion in investments backing the insurance company liabilities. In that role we were always faced with interest rate risk and tried to forecast the path of interest rates. That is an oftentimes humbling activity since it is very easy to be right for the wrong reasons and vice versa. Luck plays a large role due to externalities that cannot be forecast.

This is especially relevant for clients who are looking for a “conservative” strategy to serve as a place to hold long-term money that they can count on to conserve principal and generate somewhat stable income over time. This separate account can serve as a comfort blanket and is consistent with the “bucket” approach that is often used to simplify an overall investment strategy.

But, what makes up a “conservative” long-term investment strategy? Certainly money market investments like short-term bank certificates of deposit, money market mutual funds or Treasury Bills are “conservative”, but depending on the business cycle returns can be close to zero over an extended period like after the COVID pandemic. Likewise, long-term Treasury bonds are “safe” because they guarantee a return of principal at maturity, but can generate periodic negative returns if rates rise during their term to maturity like in 2022 when core bonds were down -13% as the Fed was tightening monetary policy.

When a client of D&A needs a long-term conservative strategy, we typically look to 100% fixed income investments with exposure to different parts of the yield curve, i.e., short-, medium- and long-term. There are many ETFs we can select from to get the exposure we are targeting. For example, iShares Ultra Short Duration Bond Active (ICSH) with a 0.6 duration, iShares Short Duration Bond Active (NEAR) with a 2.2 duration, iShares Core U.S. Aggregate Bond (AGG) with a 5.9 duration, and iShares iBoxx $ Investment Grade Corporate Bond (LQD) with a 8.0 duration cover the major parts of the yield curve. Other ETFs are often used to help fill in the very short or intermediate parts of the yield curve.

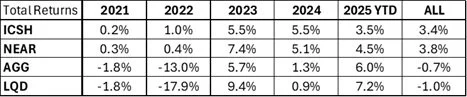

Per the table below, you can see that the periodic returns for these fixed income ETFs targeting different parts of the yield curve had significantly different return profiles. Overall, the very short and short strategies outperformed the longer strategies over the total time horizon, but not in each year. Certainly, over this selected time horizon, it was best to be diversified and tilted “short” to capture the best return profile for a conservative strategy.