We all know the risk of holding long bonds when rates rise: the prices go down! So, given the Fed’s clear mandate to raise rates until inflation subsides to the 2% range, why hold long bonds? It’s complicated!

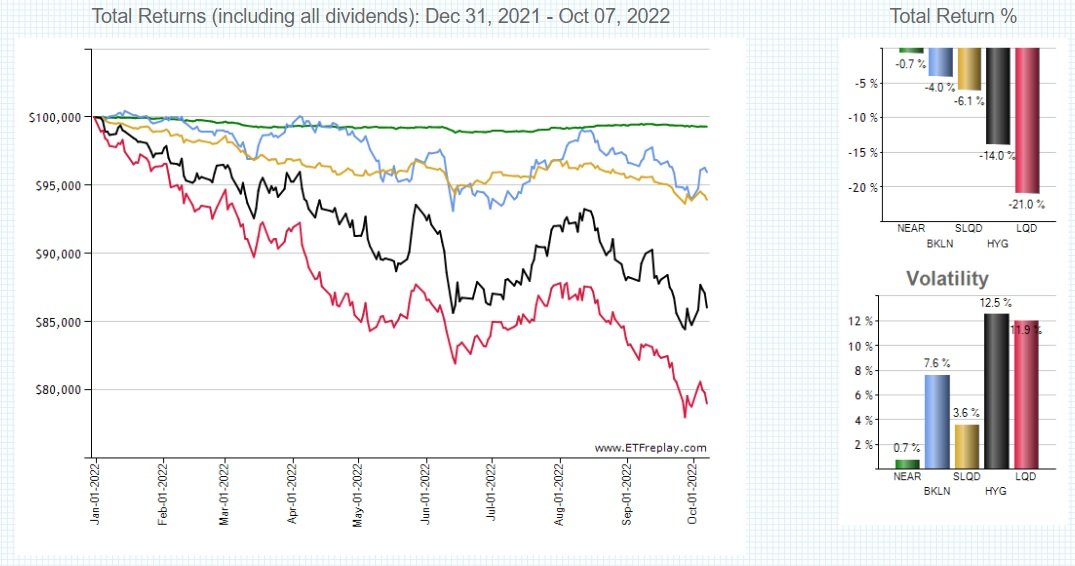

It is no secret that bond prices have been on a downward trend almost all year. As you can see from the chart below, different categories of bonds have performed quite differently; some mirroring equity returns! From very short to long, very short bonds (NEAR, 0.42 years duration) have lost almost no value during 2022 at a total return of -0.7% whereas investment grade corporate bonds (LQD, about 8.35 years duration) produced a total return of -21.0%! Other bond categories such as bank loans (BKLN, -4.0%), short investment grade corporate bonds (SLQD, -6.1%) and high yield bonds (HYG, -14.0%) produced varied returns mostly a function of their durations and other characteristics like structure, credit quality, liquidity, and supply/demand.

During the post-Credit Crisis environment of 2008/09, most thought leaders were bemoaning the inflationary and higher interest rate threat being fostered by an easy Fed. During the next 10 years that inflation threat never emerged. Likewise, in the post-Covid era the same views permeated the landscape. This time, of course, huge fiscal stimulus accompanied an easy Fed and the clogged supply chains caused a global economy to struggle to produce enough goods to meet demand exacerbating inflationary pressures. Also, it is difficult to quantify the impacts of the Russia/Ukraine war or the strong dollar, but they both have positive and negative effects.

Strategically, holding long bonds is mostly a decision tree exercise. If rates rise, because the markets have an expectation of rising inflation, then bond values will fall. Conversely, if rates fall due to lowered inflationary expectations, bond values will go up! Or, alternatively, rates could go up or down for a variety of other reasons like a Fed “mistake” of too much/too little tightening or a “flight to quality” propagated by an escalation in geopolitical tensions, or even a “black swan” event that no one can contemplate today. Simply, we hold long bonds in the case that rates fall; the timing of an event that we can not predict.

Because D&A believes in a well-diversified approach to portfolio management, no client portfolio is ever over-weighted in any one sector of bonds, or stocks, such that the direction of interest rates is less important than otherwise. Most client accounts have exposure to different bond sectors included in the chart above, as well as cash and other sectors like preferred stocks, to manage the portfolio risk profile to help clients achieve their goals.